3 Questions To Test Your Financial Literacy

Most young Americans can’t correctly answer these three financial literacy questions. Can you at your stage of life or is a lack of financial knowledge costing you?

So you think you know finance? There’s a simple way to tell: The 3 Questions to Measure Financial Literacy. These questions from the Global Finance Literacy and Excellence Center each asses one key personal finance concept.

1. “Suppose you had $100 in a savings account and the interest rate was 2% per year. After 5 years, how much do you think you would have in the account if you left the money to grow?”

A. More than $102

B. Exactly $102

C. Less than $102

D. Don’t know

E. Refuse to answer

The correct answer here is A. More than $102. There’s a simple way to figure this out without actually having to calculate the final value of the account. We know that after one year the account will have grown 2%, from $100 to $102. Then for the other 4 years the money would continue to increase, meaning the final value must be greater than $102.

Why does this question matter? This question is designed to gauge your understanding of interest rates. Whether or not you got this question right, understanding how interest works is critical to being able to manage debt or a bank account. Being able to recognize the danger of high interest loans or credit card debt, as well as the power of growing portfolios, can shape one’s financial stability.

Sign Up for Savings

Subscribe to get money-saving content by email that can help you stretch your dollars further.

Twice each week, you'll receive articles and tips that can help you free up and keep more of your hard-earned money, even on the tightest of budgets.

We respect your privacy. Unsubscribe at any time.

2. “Imagine that the interest rate on your savings account was 1% per year and inflation was 2% per year. After 1 year, with the money in this account, would you be able to buy…”

A. More than today

B. Exactly the same as today

C. Less than today

D. Don’t know

E. Refuse to answer

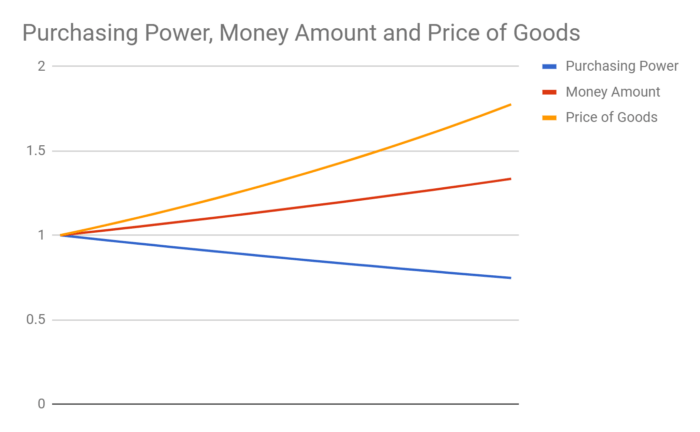

If you said the answer was C. Less than today, you’d be correct. The reason behind this is that in this case, the rate of inflation is higher than the interest rate on the savings account. That means that while the amount of money each year increases by 1%, the average price of goods and services increases by 2%! Here’s a chart which illustrates this:

This question exemplifies the importance of inflation.In fact, the premise posed in this question is not far from real life. Long term inflation rates are typically around 2% where bank account interest usually falls between .01% and 1%. Inflation is important to understand because it points out the danger in keeping all of your life savings under your mattress or in a low-interest bank account, and the importance of long-term investing.

3. “Do you think the following statement is true or false? Buying a single company stock usually provides a safer return than a stock mutual fund.”

A. True

B. False

C. Don’t know

D. Refuse to answer

The correct answer here is B. False. Buying into a mutual fund means that your money is diversified across a collection of company stocks, rather than in a single company. A single company is less safe, because it is more prone to crashes where it would be unlikely for a whole collection of companies to crash together. Investing in some mutual funds can not only diversify in different companies, but across several industries. This creates a portfolio which can survive crashes across individual companies and entire industries.

This question asses the concept of stock diversification, which leads to safer long term portfolios. Without diversifying one’s financial future is in the hands of a single corporation which could come crashing down as the result of a product recall or scandal.

Did you get all three right? If so, you did better than 75% of young Americans. But don’t get too ahead of yourself, as a study conducted by three San Diego State University professors found no correlation between financial knowledge and good financial behavior in young people, so while knowing is good, it’s important to act on that knowledge!

This article first appeard on Growthfolio.

Reviewed August 2022

About the Author

Cedric Bernard is a personal finance enthusiast dedicated to helping others save. He is a student at the University of Michigan. He blogs at Cedric Bernard and Growthfolio.

Sign Up for Savings

Subscribe to get money-saving content by email that can help you stretch your dollars further.

Twice each week, you'll receive articles and tips that can help you free up and keep more of your hard-earned money, even on the tightest of budgets.

We respect your privacy. Unsubscribe at any time.

Wouldn't you like to be a Stretcher too?

Subscribe to get our money-saving content twice per week by email and start living better for less.

We respect your privacy. Unsubscribe at any time.

Popular Articles

On After50Finances.com

- 9 Things You Need to Do Before You Retire

- You Didn’t Save Enough for Retirement and You’re 55+

- When Empty Nesters Reorganize and Declutter Their Home

- Reinventing Your Career in Your 50s or 60s

- What Mature Homeowners Should Know about Reverse Mortgages

- 2 Reasons to Collect Social Security Benefits As Soon As Possible